Today, in the face of a complex set of Environmental, Social, and Governance (ESG) indicators and their increasingly diverse practices, ESG is no longer a marginal issue in the corporate world. How to enhance ESG competitiveness through precise policy implementation and high-efficiency management has become a burning question for enterprises. With relatively limited resources at their disposal, what ESG strategies should companies prioritize?

Optimizing cost-effectiveness with ESG ratings in mind

When mapping ESG strategies in the past, companies tended to adopt the indicators and weightings of ESG rating agencies as the basis in order to achieve higher ratings. Such an approach is rational as it aligns with the rating standards investors rely upon, thus enabling enterprises to gain the upper hand in compliance, financing, etc.

However, the burgeoning ESG rating agencies and their diversified rating standards in recent years have brought new challenges to businesses. Incomplete statistics show that there are now around 600 rating bodies worldwide, each selecting different indicators and weightings. Existing research indicates that the correlation among ratings from different agencies is weak (see Table), particularly in terms of Social and Governance themes.

Table Correlation coefficients among ESG ratings of different agencies

Note: This table compares the correlation coefficients of ESG ratings of several mainstream agencies. SA, SP, MO, RE, KL, and MS represent Sustainalytics, S&P Global, Moody’s ESG, Refinitiv, KLD, and MSCI respectively. For example, the first column in the Table indicates that the ESG correlation coefficient between KLD and Sustainalytics is 0.53; the correlation coefficient for the E theme is 0.59, the correlation coefficient for the S theme is 0.31; and the correlation coefficient for the G theme is 0.02. These research results are derived from Berg et al. (2022).

Source: Florian Berg, Julian F Kölbel, Roberto Rigobon. “Aggregate Confusion: The Divergence of ESG Ratings.” Review of Finance, Vol 26, Issue 6 (2022): 1315–1344.

The uncertainty of such a rating approach produces several problems. First, even businesses that have invested heavily in ESG can still receive low ratings from some rating agencies. Second, companies that use ESG as a means of greenwashing or window dressing can instead get high ratings from some agencies. Coupled with the fact that many agencies keep churning out all sorts of league tables and awards for profit, the credibility of ESG ratings is going south. The resulting uncertainty over decisions based on ESG ratings poses formidable challenges for a wide range of decision-makers, including enterprises and investors.

To address this problem, we believe that, on the one hand, it is necessary to regulate the ESG-rating market to promote greater transparency of rating methodologies. On the other hand, enterprises should also further assess the actual costs and benefits of each ESG action and initiative so as to facilitate more rational ESG practices.

Specifically, enterprises should identify ESG actions conducive to not only social benefits but also effective cost control. By accurately identifying and prioritizing the implementation of these ESG measures, companies can ensure better value for money for each and every input. Hence, not only can a good market image and investor confidence be secured, but both social and economic benefits can also be expanded.

Ele.me sets an example with its fine-tuned interface

For implementation, enterprises are encouraged to identify low-cost ESG measures that yield high social benefits through experimentation. At the same time, companies can seek collaboration with academia to conduct precise assessments of the costs and social benefits of specific ESG action plans. We will outline a case of collaboration between Alibaba and academia to illustrate how businesses can derive greater social benefits at lower costs.

Ele.me, Alibaba Group’s online delivery services platform, is the second largest food delivery company in China, with over 700 million users in 2022. During a collaborative project with the platform, we studied how “green nudges” impacted the use of disposable tableware. Specifically, Ele.me has started a “green nudge” experiment in Beijing, Shanghai, and Tianjin. For customers in these three cities, the default option on the ordering interface is set to “no need for tableware” and those who choose this default option are awarded “Ant Forest ‘s Green Energy” points. This is a non-cash customer incentive. Once a customer has collected enough points, Alibaba will, in the name of the customer, plant trees in a desert area or launch other environmental protection actions.

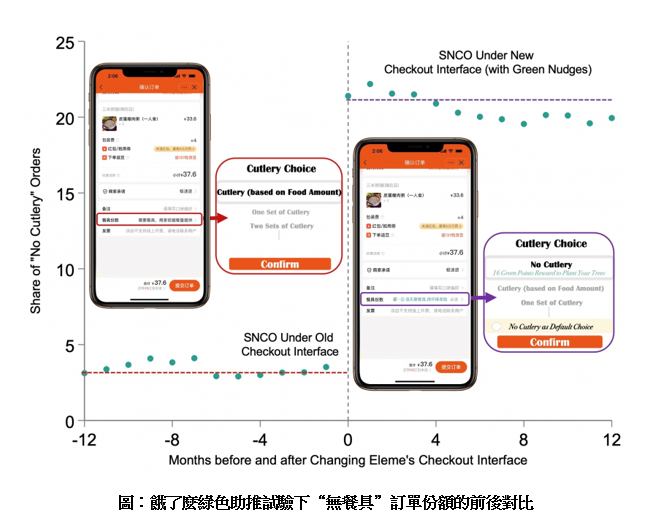

Such a change may involve minimal costs for Ele.me but what social benefits can it bring? Our analysis of users’ orders in 10 major Mainland cities between 2019 and 2020 illustrates that cities where “green nudge” measures have been introduced have seen a 648% surge in no-cutlery orders (see Figure). Nationwide implementation of such measures is expected to save over 21.75 billion sets of single-use cutlery, thus reducing 3.26 million tons of plastic waste and saving 5.44 million trees from being cut down for timber. This study was featured as the cover story of the Science magazine in 2023, gaining wide attention from global media.

Figure Share of no-cutlery orders in Ele.me’s green-nudge experiment: before and after

This case study demonstrates that it is possible for enterprises to honour their social and environmental commitments at a low cost. Just a few hours of work by a programmer is enough to generate tremendous social value. Such an innovative ESG action has not only boosted corporate ESG performance but also brought actual social benefits conducive to achieving national environmental goals.

Collaborative verification of strategy outcomes by enterprises and academia

While the collaborative study between businesses and academia mentioned above is just the tip of the iceberg, this methodology can be applied to the analysis of various problems. For instance, how can a leading company manage supply chains in terms of “E” in ESG? Given budget constraints, should enterprises invest more in reducing carbon emissions or focus more on air pollution management (in terms of “E” in ESG)? How would a wider diversity of staff and management impact the financial and ESG performance of businesses (in terms of “S” in ESG)? What assessment and evaluation mechanisms are most beneficial for enhancing business performance and staff satisfaction (in terms of “G” in ESG)? While it may be challenging for enterprises to find answers to these questions, it is a less daunting task for academia. By collaborating with academia, companies can leverage its theoretical base and data analytical capabilities to more precisely identify ESG opportunities and verify the effectiveness of their strategies. In our opinion, as far as ESG ratings are concerned, enterprises are not just “exam candidates” but should be drivers and practitioners of ESG. Undoubtedly, more collaborations between companies and academia will give a powerful impetus to ESG innovations.

Prof. Guojun He

Professor in Economics

Director, HKU Jockey Club Enterprise Sustainability Global Research Institute

Associate Director, Institute of China Economy

Ms Wendy Cui