Dr Maurice Tse and Mr Clive Ho

7 May 2025

Released by the International Monetary Fund (IMF) in April 2025, the World Economic Outlook significantly lowered global economic growth forecast from 3.3% in January 2025 to 2.8%. The report identifies China and India as the main growth engines, with the two countries predicted to contribute 23% and over 15% respectively to global economic growth in the next five years. The estimated contribution from America, nevertheless, has been lowered to 11.3% in view of the uncertainties surrounding its tariff policy.

Needless to say, the recovery of the economy worldwide is subject to the impact of continuing trade conflicts and policy uncertainties on both flanks.

Hegemony as self-destructive as it is damaging to international interests

The lowering of economic forecasts is primarily due to the tariff policy implemented by the Donald Trump Administration this year, which has caused supply chain disruptions and weakened investment sentiment, and has pushed up production costs of commodities worldwide. Forecasts indicate that global trade growth will decelerate to 1.5%, the US economy’s growth will be halved from 1.8% to 0.9%, and the eurozone economy’s growth will decline to 0.8%. The Institute of International Finance predicts that the US could experience negative growth in the second half of 2025.

According to Bloomberg’s latest survey of 82 economists conducted in April 2025, the US economy is projected to have a 45% chance of entering a recession within the next 12 months. This stems from increased tariffs imposed by the American government on various countries, which are expected to exert long-term pressure on consumption expenditure and economic growth.

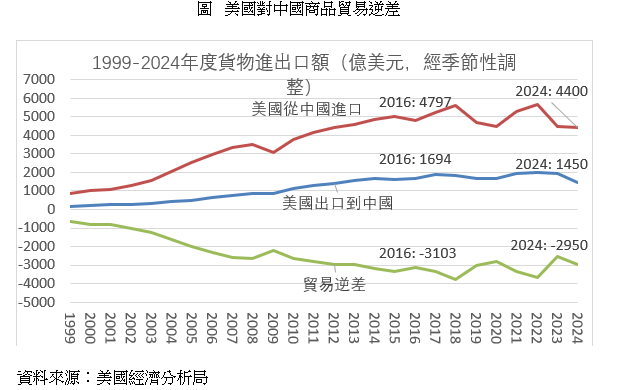

In 2024, trade between China and the US totalled around US$585 billion, of which American imports from China, at US$440 billion, significantly exceeded American exports to China, which amounted to merely US$145 billion. The US trade deficit with China, at US$295 billion, accounted for roughly 1% of the US gross domestic product (GDP) (see Figure).

From Trump’s first term to Joe Biden’s presidency, the US has steadily raised tariffs on imports from China. The decline in the share of Chinese imports from 21% in 2016 to 13% in 2023 indicates America’s diminishing reliance on trade with China. Yet during the same period, some Chinese products, such as solar panels, found their way into the US via Southeast Asian countries. According to the US Department of Commerce’s data in 2023, Chinese solar panel manufacturers had relocated their assembly operations to Malaysia, Thailand, Cambodia, and Vietnam. The goods were then exported to the US, effectively circumventing tariffs.

If the US imposes reciprocal tariffs on these products manufactured in Southeast Asian countries, the prices of imports into the US market originating from China will inevitably rise.

Figure US goods trade deficit with China

US imports from and exports to China (in US$ billion, seasonally adjusted), 1999–2024

US imports from China 2016: 479.7 2024: 440

US exports to China 2016: 169.4 2024: 145

Trade deficit 2016: -310.3 2024: -295

Source: US Bureau of Economic Analysis

Head-to-head comparison between China and US economies

In 2024, the largest American export product to China was soybeans, a key animal feed for China’s livestock industry. Chinese exports to the US mostly included electronics, computers, and toys. Among these, smartphones were the largest category, accounting for 9% of America’s total imports. A major part of the mobile phones consisted of Apple devices manufactured in China. Amid rising tariffs on Chinese goods, Apple’s market capitalization has plummeted, with its stock price collapsing 20% in the last month. These China-made US imports have become more expensive since the Trump administration implemented 20% tariffs. Should the tariff rate soar to 100% or higher, the price pressure on US consumers could quintuple. Meanwhile, China’s punitive tariffs on American imports will drive up the prices of US goods in the Mainland market, causing local consumers to incur losses.

Economic theory has long recognized that tariffs raise the prices of imported goods, thus compromising consumers’ purchasing power. Inflated import costs also shoot up the production costs of domestic companies and affect related industries through supply chains, leading to a fall in production. Greater funding pressure on enterprises may even trigger a chain reaction that stymies the investment environment.

Furthermore, as a leading supplier of the world’s copper, lithium, rare earth elements, etc.―crucial for military equipment―China can choose to limit export of these minerals to the US, disrupting its defense industry and related manufacturing sectors. On the other hand, the US has already banned the export of advanced microchips, which China has yet to be able to produce domestically, and may also pressure countries such as Cambodia, Mexico, and Vietnam to curb their trade with China.

Tariffs set to boomerang on America itself

In the US government’s bid to levy at least 10% tariffs on most countries this time, some of the punitive tariffs have been put on a 90-day pause. However, as pointed out by research of Bloomberg Economics, America’s current effective tariff rate already stands at 23%, a record high in this century. This is bound to trigger a sharp contraction in US household demand, given that consumption expenditure is the driving force of the country’s GDP (with roughly a two-thirds share), and to induce an extra risk of economic recession.

International agencies warn that maintaining high tariffs on a long-term basis will have a cascading impact on global supply chains and economies. Data of Bloomberg shows that US imports in the first quarter of 2025 increased by 19.2% year-on-year, as companies managed to stock up in advance of the new tariffs. Even so, forecasts for US imports and exports towards 2027 have been adjusted downwards, with exports expected to decline until 2026. Retaliatory tariffs on American goods imposed by other countries, including China, will further undermine the international competitiveness of these goods.

Similarly, the potential repercussions on inflation should not be overlooked. Survey results reveal that the Personal Consumption Expenditures (PCE) Price Index at the end of 2025 is estimated to be 3.2% while the core PCE inflation rate is forecast to reach 3.3%, both of which are higher than the earlier estimate of 2.7%. According to Comerica Bank economists Bill Adams and Waran Bhahirethan, although America’s inflation is unlikely to return to its peak in 2022, inflation surge will narrow the Federal Reserve’s room for rate cuts. Despite the slowdown in economic growth, the labour market remains resilient. Forecasts indicate that unemployment rate in the US will edge up to 4.6% by the end of 2025, slightly higher than the previous estimate of 4.3%.

Progressive transformation of the Chinese economy

Undoubtedly, owing to the impact of the escalating US tariff policy, the growth forecast for the Chinese economy has been adjusted downwards to 4%, which is lower than the earlier forecast of 4.6%. In the opinion of economist Stephen S. Roach, while China’s state-led industrial policy may initially withstand the effects of the trade war, its export-oriented economy is likely to suffer heavily if tariff tensions continue to build up.

Even though China has advocated shifting from an export-oriented economy to one driven by domestic demand, achieving this transition will be no easy task. As a result of a less than perfect social security system, Chinese families prefer to scrimp and save, contributing minimally to consumption expenditure. In spite of the introduction of the “30-Point Action Plan to Lift Domestic Consumption”, which demonstrates the Central Government’s concern about related issues, the social security system still requires substantial improvement. The US tariff policy has not only exacerbated tensions between China and the US but has also limited the growth potential of both economies. In addition to addressing external pressures, China should also focus on internal structural problems. This will likely have a far-reaching impact on future economic developments.

The global bane of high tariffs

Given that China and the US together account for 43% of the world economy, if the two countries engage in a full-on trade war, it could cause a slowdown or recession, implicating global economic stability and severely compromising investment activities worldwide.

As the world’s largest manufacturer, China has a production capacity that significantly exceeds its domestic demand. Hence, it does not come as a surprise that the nation exports much more than it imports. Thanks to policy measures such as government subsidies and low-interest loans, many products (e.g., steel) can be manufactured at lower than actual costs. Should Chinese companies find it impossible to export their products to the US, they will likely look elsewhere. Consequently, while consumers in other countries may benefit, manufacturers and employment in those markets will suffer. For example, UK Steel, the trade association for the UK steel industry, has already warned that the possibility of China’s excess capacity in steel production being redirected to the UK market could threaten related sectors in the UK.

Moreover, there is a consensus among economists regarding the China-US trade war that it will create highly destructive spillover effects. With a divergent trend among developing countries, some emerging markets could be subject to a greater impact. Growth in emerging markets and developing economies this year is projected to be reduced to 3.7%, which is 0.3% lower than the previous estimate. The downward pace of global inflation will also be slower than anticipated, with the average global inflation rate forecast to stand at 4.3% for the year. Developed economies are expected to face particularly intense inflationary pressures.

According to simulation analysis, should the tariff war further escalate, global economic growth could slide by another 1.5%, setting off seismic waves in the international financial market. Heightened multinational trade tensions will pose a long-term threat to productivity and economic growth. It is therefore essential to maintain stable trade policies. Governments worldwide should avoid taking unilateralist measures and should strengthen monetary policy coordination to prevent fragmentation of the global financial system.