Highlights

- Policymakers should consider how fund-level liquidity practices contribute to systemic risk in major financial markets.

- Monitoring ownership patterns can help anticipate non-fundamental price fluctuations and improve market stability.

- Well-intentioned regulatory shifts can have ripple effects, highlighting the need for holistic policy design and coordination across financial sectors.

The U.S. Treasury market is globally recognised as the ultimate safe haven for investors. Regulators and economists, however, note that this market is increasingly prone to sudden price swings and instability. One case of this was during the 2020 COVID-19 crisis. A significant cause of this new fragility could be the standard operating model of corporate bond mutual funds.

The Core Problem: Managing Cash Flow with Treasuries

Corporate bond mutual funds face a mismatch in that they hold corporate bonds, which can be hard to sell quickly (illiquid), but they promise investors they can withdraw their money on demand (making them liquid).

To manage this risk, especially from the danger of a “run” by investors, funds hold a buffer of highly liquid assets they can easily sell to raise cash. The asset of choice for this buffer is U.S. Treasury bonds. This practice, known as liquidity management, means that funds trading in the Treasury market are heavily driven by investor deposits and withdrawals, or fund flows. When investors withdraw money, funds sell Treasuries first to meet redemption requests. When new money comes in, it’s often routed first towards the Treasuries market before being invested in corporate bonds.

The study found that for a 1% fund inflow, a fund’s Treasury holdings increased by 1.42%, while corporate bond holdings increased by only 0.84%, confirming that Treasuries are used as a disproportionate buffer.

Linking Fund Behaviour to Market Volatility

The study showed that these dynamics directly impact Treasury prices. By analysing data from 2002 to 2021, the researchers found that Treasury bonds with higher ownership by these bond funds had greater “excess volatility.” They had price swings that were not explained by general market trends. An increase in fund ownership was associated with a 4.4% rise in a Treasury holding’s excess volatility, relative to the sample average.

To pinpoint the cause, the researchers identified funds that most aggressively use Treasuries as a buffer, labelling them “high-LMI” (Liquidity Management Intensity) funds. The impact on volatility from ownership by these high-LMI funds was over four times stronger than that of other funds, isolating liquidity management as the key driver.

“The study provided clear evidence that the way that open-end bond funds manage liquidity can itself influence the stability of the Treasury market”

Causal Evidence from Real-World Events

To prove this wasn’t just a correlation, the study examined two key events:

- The 2017 SEC 2017 Liquidity Risk Management Rule: The SEC rule forced certain U.S. funds to hold more liquid assets. The study showed that the funds most affected by this rule significantly increased their use of Treasuries for liquidity management. Subsequently, the specific Treasuries these funds held became more volatile after the rule was enacted.

- The March 2020 COVID-19 Crash: During that market panic, bond funds faced massive investor withdrawals. The researchers found that Treasuries heavily owned by the high-LMI funds suffered much larger price declines. These prices fully recovered after the Federal Reserve intervened, indicating the drops were caused by forced selling from funds, not a change in the bonds’ fundamental value.

The study provided clear evidence that the way that open-end bond funds manage liquidity can itself influence the stability of the Treasury market. Two key areas of research were presented. First, the relationship between liquidity management and asset pricing. Second, the dynamics behind the COVID-19 Treasury market disruption.

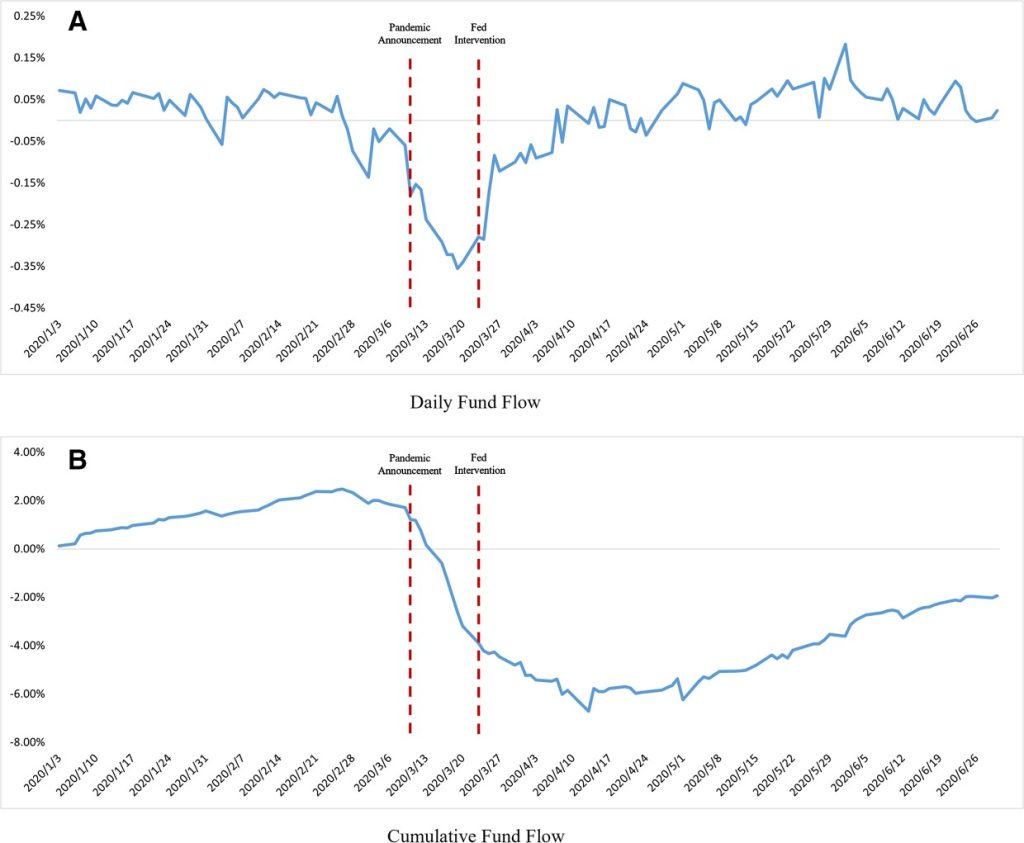

To illustrate these findings, starting in early March 2020 and before the COVID-19 pandemic was officially declared, bond funds saw sharp outflows. This aligned with previous research. From the study findings, withdrawals exceeded 5% of pre-COVID values.

What stood out was that Treasuries held by funds with higher LMI dropped more in value (Figure 1). These price declines were later reversed following the U.S. Federal Reserve’s intervention, pointing to temporary pressure from liquidity practices rather than fundamental changes.

Fig. 1 Fund flows during the COVID-19 pandemic announcement and the U.S. Federal Reserve’s intervention. This figure plots the weighted average daily fund flows (panel A) and cumulative fund flows (panel B) for all bond funds in our sample from 2020Q1 through 2020Q2.

The study provides direct and causal evidence on the effect of open-end bond funds’ liquidity management on Treasury fragility. The study contributes to the literature on liquidity management and its asset pricing implications. This is the first study that used the 2017 Liquidity Risk Management Rule as an exogenous shock to the liquidity management of open-end bond funds with Treasuries and to provide causal evidence of the effect of liquidity management on Treasury fragility. The study also suggests that the 2017 Liquidity Risk Management Rule and the increasing size of bond funds contributed to the turmoil during the COVID-19 period.

The research findings have important policy implications, and caution against the possible unintended consequences of liquidity management policies.

Keywords:

Mutual funds, Corporate bonds, Treasury, Liquidity management

Learn more from the full article here:

https://doi.org/10.1093/rfs/hhae082